This article was originally authored by The Wall STREET JOURNAL and published on their official website dated 25th April 2022. SECQRD.COM does not claim the ownership of this article and is merely republishing the article for general public view in line with supporting the common mission to promote sustainable use of products globally in the effort to reduce wastages. All IP and copyright of the content and images in this article belongs solely to The Wall STREET JOURNAL

.

Makers of mattresses are cutting costs and delaying product launches amid falling demand for big-ticket items, marking a reversal for a sector that benefited from increased home-improvement spending early in the pandemic.

Companies including Sleep Number Corp. and Tempur Sealy International Inc. have said in recent weeks that demand for their products has started to decline. Executives and analysts said consumers are likely pulling back on home-goods spending due to a mix of factors, including rising inflation and the economic impact of Russia’s invasion of Ukraine. The pullback, analysts said, could mark the beginning of a more sustained drop in spending on durable discretionary items, a category that includes goods that sold well during the pandemic, such as grills and patio furniture.

The slowdown marks a shift from the past two years, when sales of mattresses and other furniture surged as consumers spent more time at home due to the Covid-19 pandemic.

U.S. consumers spent about $298.5 billion on furniture and furnishings in 2021, up 22% from 2020 and 31% from 2019, the year before the pandemic, according to the U.S. Bureau of Economic Analysis.

“I think mattresses are an early tell on a spending slowdown,” said Peter Keith, an analyst at financial-services company Piper Sandler Cos. A mattress is a relatively easy purchase to defer because they wear out rather than break and consumers don’t look at them daily, Mr. Keith said.

Signs of weakening demand prompted Minneapolis-based Sleep Number to cut $10 million from its planned expenses for the quarter ended April 2, largely by reducing spending on marketing and bonuses, said David Callen, the company’s finance chief. Still, total operating expenses rose 7% from a year earlier, to $297.9 million, partly due to supply-chain problems and the impact of the Covid-19 wave caused by the Omicron variant.

Sleep Number’s products include chips for controlling the firmness of a mattress and adjusting the bed base to raise and lower the head and foot of the bed. Net sales in the quarter ended April 2 declined 7% from a year earlier, to $527.1 million, due to a constrained supply of computer chips, while customer demand fell 3%. Earnings fell to $2.1 million from $66.6 million.

The company, which has a backlog of orders that is $200 million higher than normal levels, said it expects to deliver fewer beds in the second quarter than it did in the first.

Mr. Callen said Sleep Number offered additional promotions after sales began to slow. That came after the company raised prices several times last year to offset higher labor, shipping and commodities costs.

Prices on Sleep Number’s technology-enhanced mattresses range from about $900 to about $5,000, according to the company’s website. Sleep Number also suspended share repurchases when it saw a drop in demand in March, Mr. Callen said. The company bought $42 million of its own shares during the quarter ended April 2, down from $167 million a year earlier. “We’re being very cautious,” he said.

Sleep Number faces continuing supply-chain challenges due to the global semiconductor shortage. The company is also being hit by Covid-19-related factory closures and slowdowns in Shanghai, where a key chip supplier is located, Mr. Callen said. “We’re going to be operating, in effect, inefficiently,” meaning the company expects a lower volume of bed deliveries in the coming weeks as it works through its supply-chain issues, he said.

Growing pessimism among consumers has begun to weigh on sales for big-ticket purchases such as mattresses, said Atul Maheswari, an analyst at UBS Group AG. Consumer confidence began to tumble last year as prices rose and households spent the cash they got from pandemic-stimulus programs. Inflation in March accelerated to a four-decade high of 8.5%.

“Consumers need to feel confident about themselves. Overall consumer confidence matters a lot for this type of purchase,” Mr. Maheswari said.

Mattress company Tempur Sealy on March 31 said that its sales came in below expectations following the Presidents Day holiday in February due to macroeconomic factors including falling consumer confidence and geopolitical uncertainty. The Lexington, Ky.-based company, which sells its products in over 100 countries, said it would delay the launch of a new international product line from this year until the first quarter of 2023.

Post-pandemic

“We remain committed to making investments in marketing, product launches, and our operations this year to support the long-term growth trajectory of the business,” Chief Executive Scott Thompson said in a statement.

The company, which reports first-quarter results Thursday, said it expects year-to-year net-sales growth of 15%, a deceleration from the quarter ended Dec. 31, when net sales increased 29% from a year earlier, to $1.36 billion.

The cost of a Tempur-Pedic mattress—one of the company’s brands—can range from about $2,000 to more than $4,000, according to the company’s website. A Sealy mattress costs roughly $500 to $2,500. Tempur Sealy declined to make its finance chief available for an interview.

Upscale furniture maker RH, formerly Restoration Hardware, also said last month it observed a slowdown in orders starting in late February. Chief Executive Gary Friedman pointed to a range of factors, including the war in Ukraine, to explain the pullback in demand.

In addition to waning consumer confidence, recent stock-market declines also affected the net worth of high-income households, adding additional pressure to consumer spending, said Piper Sandler’s Mr. Keith.

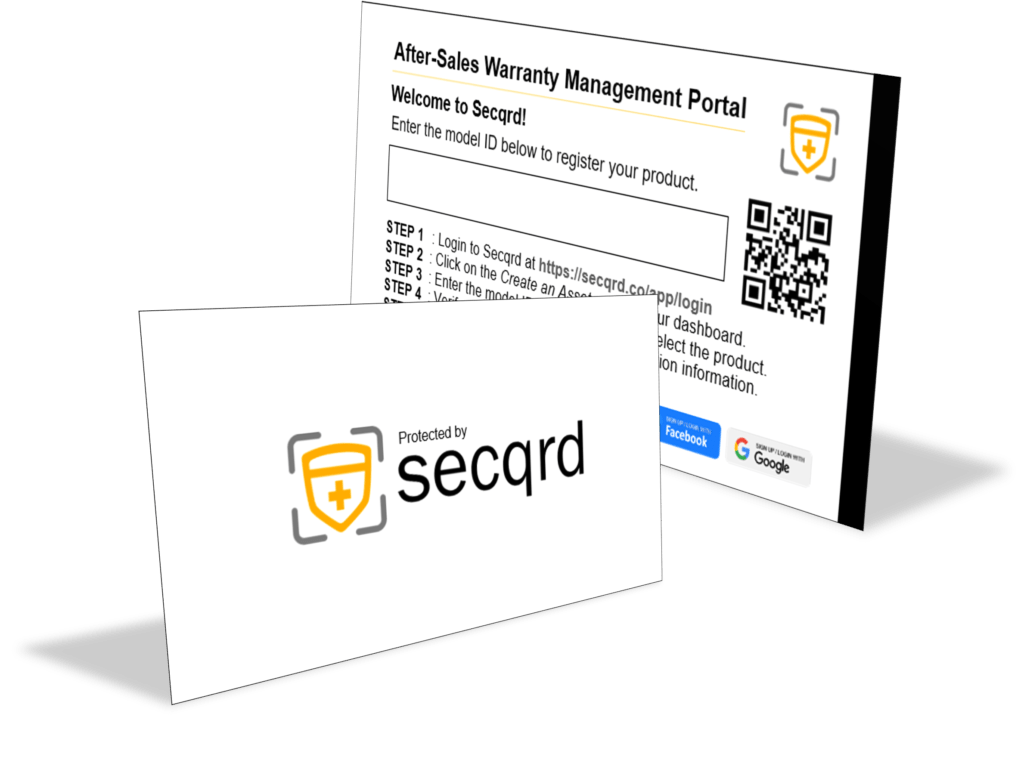

Secqrd is an after-sales engagement tool tailored for products that are sold with a warranty. We connect merchants directly with buyers via e-warranty registration, enabling in-app communication, issue loyalty vouchers, data analytics and merchants can upsell 20+ addons to buyers after an initial sale.

United Kingdom

United Kingdom  Singapore

Singapore  Australia

Australia